Estimate depreciation on rental property

How do you calculate depreciation on primary residence. If not then it will be in the paperwork from the purchase.

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

You also plan on spending an additional 30000 to renovate it before selling.

. If you wanted to calculate the amount that can be depreciated each year youd take the basis and divide it by the 275 year recovery period. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Building Value 275 Yearly allowable depreciation deduction.

For instance the depreciation of a property worth 75000 and land worth 25000 would look like this. To do it you deduct the estimated salvage value from the original cost and divide by the useful life of the asset. GDS is the most common method that spreads the depreciation of rental property over its useful life which the IRS considers to be 275 years for a residential property.

Cost of the Building - Value of the Land Building Value. To find out the basis of the rental just calculate 90 of 140000. 369000 property cost basis 275 years 1341818 annual depreciation expense.

Straight-line depreciation gets explained more in-depth later but this simply means that the cost basis of the property less the value of items that cant get depreciated will be depreciated each year equally over 275 years. Ad Get Access to the Largest Online Library of Legal Forms for Any State. So the basis of the property the amount that can be depreciated would be 99000.

That means if you paid a total of 115000 for a single-family rental home and the land value was 10000 your annual depreciation expense would be 3818 or 3636 of the property value each year. For rental property purposes its important to note that a 1 to 4 unit building is considered residential property and a 5 or more unit building is considered a commercial property. Purchase price land value improvements 200000 40000 2000 180000.

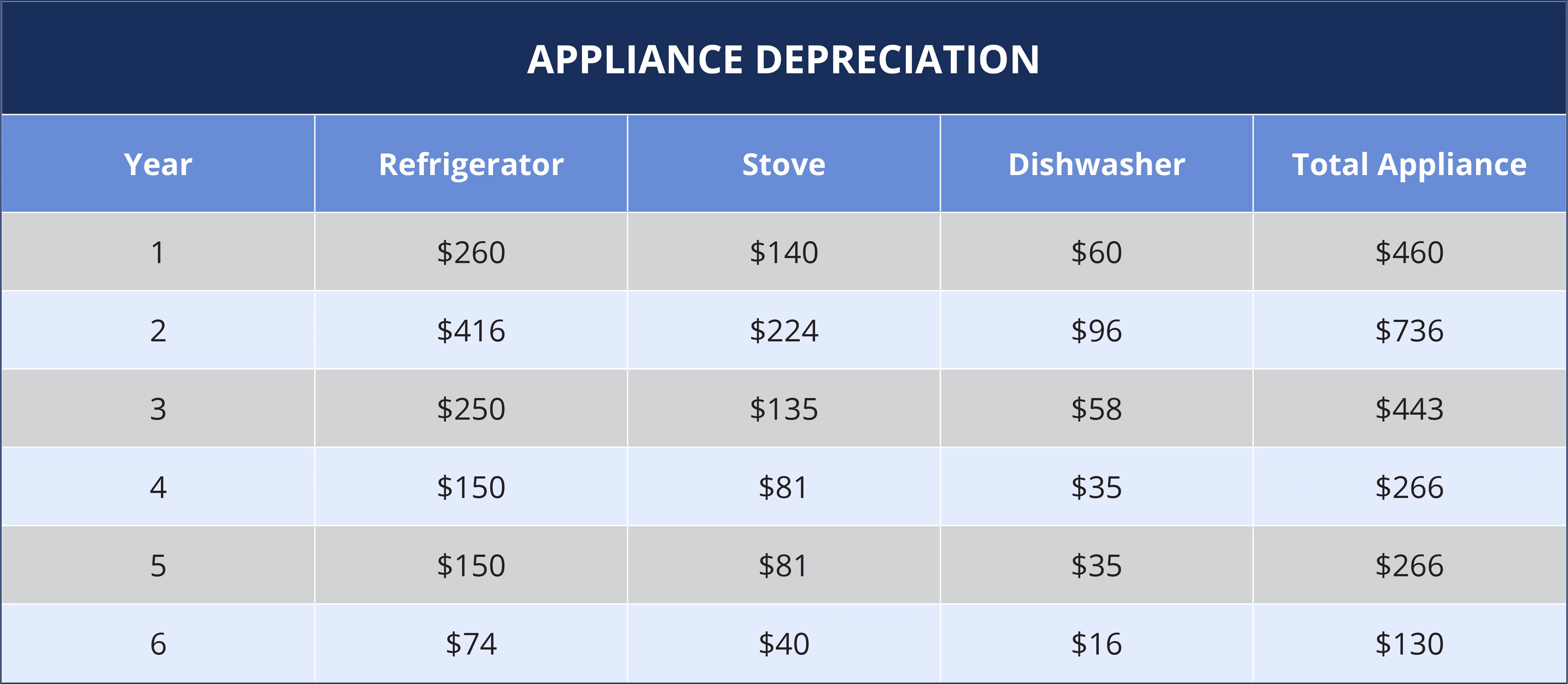

7 steps to calculate depreciation on rental property Determine the purchase price of the property The first step is to determine how much you paid for the property. Calculating Depreciation In Rental Property. For example if a new dishwasher was purchased for 600 had an estimated useful life of five years and would be worth 100 at resale at the end of the five years then the annual depreciation using the straight-line method.

99000 275. To calculate your initial cost basis you would take. Lets say you paid 200000 for a rental property but its sitting on a 40000 plot of land.

In order to calculate the amount that can be depreciated each year divide the basis by the recovery period. In our example lets use our existing cost basis of 206000 and divide by the GDS life span of 275 years. 105000 275 years 3818 annual depreciation.

For commercial properties the useful life of a property is 39 years. The result is 126000. If you use 15 percent of your house for business and the.

This formula is used to calculate depreciation. It works out to be able to deduct 11200 per year or 36 of the loan amount. Deduct the value of the land.

Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life. 75000 25000.

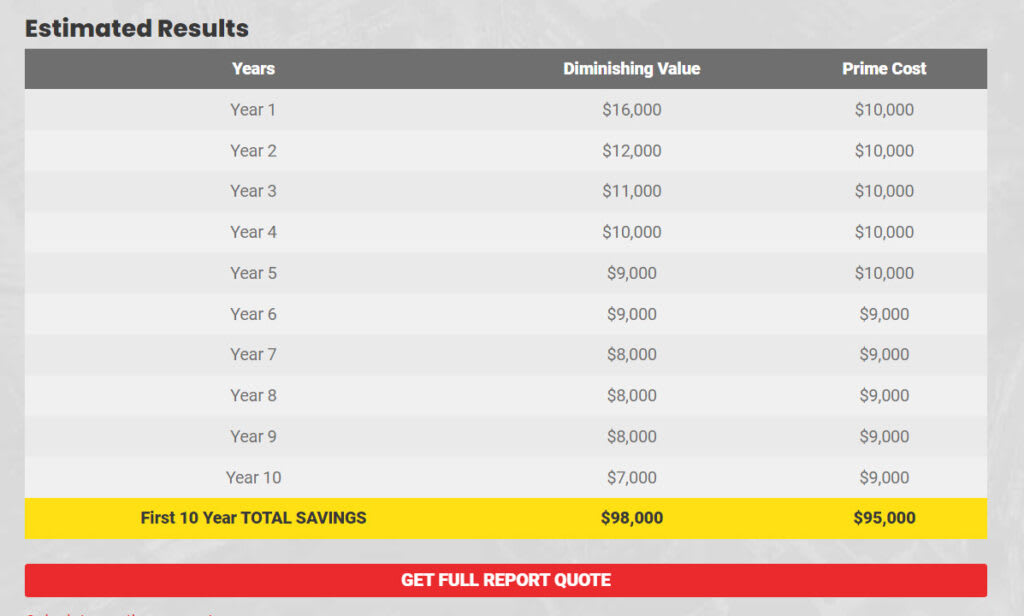

Lets consider the above example for this cost basis of 308000 and divide by the GDS life span of 275 years. To learn more about the depreciation calculator or to request a personalised depreciation estimate contact us today. It works out to being able to deduct 749091 per year or 36 of the loan amount.

In this case since residential rental property can be depreciated for 275 years you would depreciate 4589 per year. Using the above example we can determine the basis of the rental by calculating 90 of 110000. This is pretty easy since you probably know it offhand.

115000 total purchase price 10000 land value 105000 cost basis to depreciate. Use straight-line depreciation for a rental property that falls into the category of 275 year recovery periods. Now you need to divide the cost basis by the propertys useful life to calculate the annual depreciation on a property.

How To Calculate Depreciation On A Rental Property. Use whichever figure is smaller to calculate depreciation.

How To Calculate Depreciation On A Rental Property

Residential Rental Property Depreciation Calculation Depreciation Guru

How To Use Rental Property Depreciation To Your Advantage

Residential Rental Property Depreciation Calculation Depreciation Guru

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

How To Calculate Depreciation On Rental Property

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

How Depreciation Claiming Boosts Property Cash Flow

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

Depreciation For Rental Property How To Calculate

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

Rental Property Depreciation Rules Schedule Recapture

How To Calculate Depreciation On Investment Property Wb

Rental Property Depreciation Rules Schedule Recapture

How Much Is A Rental Property The Up Front Recurring Costs

Converting A Residence To Rental Property